IRS Finds 23andMe Genetic Results are a Medical Expense

Deadline for Distributing Medicare Part D Creditable Coverage Notice Is Approaching!

How to Handle Court Orders Mandating Coverage to an Ex-Spouse

New Opportunities for Health Reimbursement Arrangements

IRS Finds 23andMe Genetic Results are a Medical Expense

In exchange for a small DNA sample, 23andMe provides individuals with ancestry and genetic results. Users collect a sample of their DNA and send it to

23andMe for testing through a process called genotyping. Ancestry results alone currently cost $99, but if people are willing to pay $199, they can be provided ancestry and genetic information, which includes information about health predispositions and whether the individual is a carrier for certain medical conditions. Although 23andMe is not the only business that offers this service, it is one of the most well known in the marketplace.

Recently, perhaps due to the growing popularity of such services, the IRS has issued a Private Letter Ruling, indicating that while the costs for ancestry analysis are not an Internal Revenue Code (IRC) 213(d) medical expense, expenses for genetic testing can be. Similarly, the IRS previously determined that body scans for an individual who was generally asymptomatic and fees for the storage of this information were medical expenses. In general, medical expenses under IRC Section 213(d) are the costs for the diagnosis, cure, mitigation, treatment, or prevention of disease. Medical expenses can be paid or reimbursed with individuals’ health savings accounts (HSAs), health reimbursement arrangements (HRAs), and flexible spending accounts (FSAs). While a Private Letter Ruling is not official guidance from the IRS and may only be relied on by the employer who requested the ruling, the ruling is instructive regarding the IRS’ view on reimbursable medical expenses.

In reviewing the issue, the IRS clarified that an individual wishing to be reimbursed for the genetic analysis offered by 23andMe, which combines the cost of both ancestry (not a medical expense) and the genetic testing (a medical expense) would have to assign a value to the genetic testing component of the service. The IRS stated that the taxpayer must use a “reasonable method” to differentiate between the medical and non-medical expense. In this case, it would appear to be reasonable to allocate $100 to the genetic services and $99 to the ancestry services. As such, only $100 would be considered a medical expense. 23andMe has already posted this ruling on its website and has a calculator to help customers determine how much of the cost is allocable to medical expenses, but the IRS has not specifically addressed whether the 23andMe calculator’s results are approved as reasonable.

This allocation of medical expenses may create difficulties for plan sponsors who must process or reimburse participants solely for the portion of the payment that represents a medical expense. For example, many FSAs provide debit cards to participants to pay for medical expenses. If only part of the cost is a medical expense, plan sponsors and third-party administrators may need to carefully review expenses from companies that provide genetic analysis to ensure that they are not inadvertently reimbursing ancestry results which would not be eligible for reimbursement.

The IRS’s position in this private letter ruling may be the beginning of a trend, and perhaps the IRS will offer further guidance on whether other direct-toconsumer health care products such as smartwatches or other devices that monitor individual’s biometrics, for example, qualify as medical expenses. Stay tuned for future guidance.

The IRS Offers Additional Relief for HDHP HSAs: New Preventive Care Benefits for Certain Chronic Conditions

Background: HDHP-HSAs and Preventive Care

A health savings account (HSA) is a popular vehicle for paying health care costs. Employees find HSAs attractive because they can control the amount of money contributed, determine when to withdraw money, and enjoy the benefits of what is essentially a tax-favored savings account – money can be contributed, earned, and distributed for qualified expenses on a tax-free basis. Not to mention the fact that HSAs are portable.

In order to participate in an HSA, an employee must be enrolled in a high deductible health plan (HDHP), an insured or self-insured plan that meets specific IRS guidelines, notably, higher minimum deductibles, lower premiums than traditional health plans, and maximum out-of-pocket expense limits. Because qualifying HDHP coverage is a precondition for HSA contributions, employers must ensure that their HDHPs are compliant with an ever-evolving matrix of federal guidelines impacting the plan coverage.

One fundamental requirement of an HDHP is that it may not provide benefits in any plan year until the deductible for that plan year is satisfied. However, the IRS provides an exception to that general rule for certain types of “preventive care” – preventive care provided without cost sharing under the Patient Protection and Affordable Care Act (ACA) (mandatory), and preventive care that may be provided with no or low-cost sharing or lower deductibles, via other applicable IRS guidance and safe harbors (permissive).

So What’s New?

On June 24, 2019, President Trump issued Executive Order 13877, requiring the Treasury Department and IRS to consider ways to lawfully expand the use and availability of HSA-HDHPs, specifically the accessibility of preventive care coverage for individuals with existing chronic conditions. On July 17, 2019, the IRS issued Notice 2019-45, guidance on the subject in response to the executive directive. It became effective immediately upon publication.

In Notice 2019-45, the IRS and Treasury Department reiterated and confirmed that preventive care does not generally include services, benefits, or treatment for existing conditions, illnesses, or injuries. However, the agencies acknowledged the serious complexities – and harsh impacts – associated with applying this rule to persons with chronic conditions.

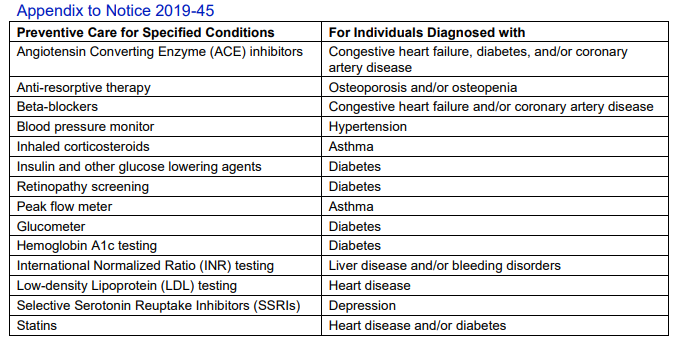

Upon consultation with the Department of Health and Human Services, the IRS and Treasury Department provided a specific “List of Additional Preventive Care Services and Items For Chronic

Conditions That May Be Treated As Preventive Care For Purposes of Section 223(c)(2)(C)” – that is, preventive care benefits that can be provided under an HDHP without impacting a participant’s ability to contribute to an HSA. (See the table below.)

The IRS and Treasury Department commented on characteristics shared by the medical services and items, namely:

- The service or item is low-cost;

- There is proven evidence of a large impact to preventing the exacerbation of the chronic condition or development of a secondary condition; and

- There is clinical documentation and strong likelihood that use of the specific service or item will prevent the exacerbation of the chronic condition or development of a secondary condition that requires significantly higher cost treatments.

Although the criteria used to compile the list was shared, the drafters noted three very important points. First, they reiterated that the items listed in the Appendix, and the criteria used to select those items, do not expand the scope of preventive care.

Second, Notice 2019-45 does not alter the ACA’s definition of preventive care benefits, so those benefits must continue to be offered without costsharing. Third, although the items on the list are considered preventive, they are considered preventive for IRC §223 purposes (which are permissive), and not for ACA purposes (which are mandatory) – therefore the new preventive care benefits for chronic conditions can be subject to copays, coinsurance, and deductibles.

What Does This Mean for Plan Sponsors?

The guidance in Notice 2019-45 became effective immediately, so plan sponsors may amend their HDHPs now or incorporate changes at the start of the next plan year. Also, plan sponsors may permit the plan to cover the specified preventive care benefits for chronic conditions at no cost or with some form of cost sharing.

Practice Tip Reminder

The definition of “preventive care” for purposes of HSA-HDHP compliance is governed by federal statute, Notice 2004-23, and other IRS guidance and not by Archer Medical Savings Account provisions or state insurance law requirements. The impact of this guidance was recently demonstrated in tension between federal and state categorization of male sterilization and contraceptive coverages. In Notice 2018-12, the IRS concluded that male contraceptives and sterilization were not preventive care under the Social Security Act or under IRS or Treasury Department guidance despite various state mandates for coverage on a first-dollar basis. As a result, HDHPs offering these benefits before the minimum deductible is met, are not HSA-eligible. The IRS provided transition relief through periods before 2020. In other words, any insured plans that are required to continue to comply with a state mandate for this type of coverage will not be HSA-eligible in 2020.

Deadline for Distributing Medicare Part D Creditable Coverage Notice Is Approaching!

The annual deadline for providing Medicare Part D Notices of Creditable Coverage is coming up on October 14, 2019. Each year, employers that offer prescription drug coverage under their group health plan are required to provide notices of creditable or non-creditable coverage to Medicare-eligible individuals. Notices to Medicare eligible individuals must be distributed before the annual Medicare Part D enrollment period, which begins on October 15.

What is a Notice of Creditable Coverage

Medicare Part D notices provide important information to individuals for Medicare Part D enrollment. First and foremost, the notice discloses whether a plan’s prescription drug coverage is

creditable. Coverage is generally considered “creditable” if it is expected to pay on average as much or more than the standard Medicare Part D prescription drug coverage. The Centers for Medicare & Medicaid Services (CMS) has published model disclosure notices for use by employers on and after April 1, 2011. These notices are accessible online at https://www.cms.gov/Medicare/Prescription-DrugCoverage/CreditableCoverage/Model-NoticeLetters.html

Additionally, creditable coverage notices may assist Medicare eligible individuals with avoiding late enrollment penalties. If eligible individuals fail to enroll in Part D coverage during their initial enrollment period, they may be subject to late enrollment penalties consisting of higher Medicare Part D premiums on a permanent basis. However, an individual can avoid the late enrollment penalty if they maintained creditable coverage. Thus, the notice of creditable coverage can serve as proof that the individual maintained creditable prescription drug coverage since the end of their initial enrollment period for Part D and allow the individual to avoid late enrollment penalties.

Who Must Receive a Notice of Creditable Coverage

Notice must be provided to all Part D eligible individuals who are enrolled in or seeking to enroll in the employer’s group health plan. Part D eligible individuals may include active employees, disabled employees, COBRA participants, retirees, and covered spouses and dependents of any of these individuals. Employers are generally permitted to provide a single notice to both the Part D eligible individual and all of his or her Part D eligible dependents covered under the same plan. However, a separate notice must be provided if the employer knows that a spouse or dependent who is Part D eligible resides at a different address from the participant.

When to Provide the Notice of Creditable Coverage

Employers must provide notices of creditable coverage to Medicare Part D eligible individuals at the following times:

- Prior to commencement of the annual coordinated election period (ACEP) for Medicare Part D

- Prior to an individual’s initial enrollment period (IEP) for Part D

- Prior to the effective date of coverage for any Part D eligible individual that enrolls in the employer’s prescription drug coverage

- Whenever the employer no longer offers prescription drug coverage or changes it so that it is no longer creditable or becomes creditable

- Upon request by the Part D eligible individual

CMS will presumably consider the ACEP and IEP disclosure requirements met if notices are provided to all plan participants annually prior to October 15 of each year, assuming that all other conditions associated with the notices have been satisfied. Employers who do not provide prescription drug coverage are not required to provide a notice of creditable coverage.

How to Provide the Notice of Creditable Coverage

Notices of creditable coverage may be provided separately or with other plan information such as enrollment materials or summary plan descriptions (SPDs). If provided with other information, the notice must be “prominent and conspicuous,” which is generally satisfied if the disclosure notice portion of the document (or a reference to the section in the document being provided to the individual that contains the required statement) is prominently referenced in at least 14-point font in a separate box, bolded, or offset on the first page of the information being provided.

Notices of creditable coverage may be provided by mail or by electronic means, provided that electronic delivery must meet certain criteria under the Department of Labor’s (DOL’s) electronic disclosure requirements. These requirements generally allow electronic disclosure to participants “who have the ability to access electronic documents at their regular place of work if they have access to the plan sponsor’s electronic information system on a daily basis as part of their work duties.” If this method of delivery is chosen, the employer must inform participants that they are responsible for providing a copy of the disclosure to their Medicare eligible dependents covered under the group health plan.

Electronic notice may also be provided to retirees (and other individuals who do not access a computer as part of their work for the employer) if the Part D eligible individual indicates to the employer that they have adequate access to electronic information and they agree to receive information electronically. The employer must obtain a valid email address and the individual must submit their consent electronically to the employer. However, before individuals can agree to receive information electronically, they must be given a clear statement that explains:

- The types of documents to which the consent will apply

- That the consent can be withdrawn at any time without charge

- The procedures for withdrawing consent and for updating the address used for receipt of electronically furnished document

- The right to request and obtain a paper version of an electronically distributed document, and whether the paper version will be provided at no charge

- The hardware or software needed to access and retain the documents delivered electronically (and if the hardware or software requirements change, an updated statement must be provided and a new consent must be obtained)

Given the complexity of the DOL’s electronic disclosure rules, employers utilizing electronic delivery should consult their broker or ERISA counsel to ensure that their administrative practices satisfy the DOL’s requirements.

How to Handle Court Orders Mandating Coverage to an Ex-Spouse

It is not uncommon for an employer to receive a court order, most often a divorce decree, mandating the provision of health coverage. Often the mandate constitutes a “qualified medical child support order” (QMCSO) requiring an employee to cover his or her children. Group health plans governed by the Employee Retirement Income Security Act (ERISA) are required to honor a QMCSO. However, when a court order involves an ex-spouse, instead of a child, the laws are different both on the federal and state level, which often leads to a different and contrary result. Some employers may have provisions causing a loss of coverage upon legal separation as opposed to divorce. Although this article focuses on coverage post-divorce, employers with plans excluding spouses after legal separation should follow a similar analysis.

First, from the federal perspective, there is no federal statute, other than COBRA, requiring group health plan coverage for an ex-spouse. For example, ERISA §609 requires ERISA plans to recognize QMCSOs, but does not contain a similar requirement for ex-spouses. On the other hand, ERISA does specifically provide for the division of pension and 401(k) benefits with an ex-spouse pursuant to a “qualified domestic relations order” or QDRO. While a handful of federal circuits have concluded that a QDRO could apply to welfare plans such as group medical, those decisions all have involved ERISA life insurance plans and not health plan benefits. From a state perspective, there are a handful of states that have laws requiring insured plans to provide coverage for ex-spouses, independent of COBRA, but those laws are generally not applicable to self-insured plans.

Although the task of analyzing such a request may seem daunting, it is important to do so, particularly for ERISA fiduciaries. ERISA requires that a plan be administered in accordance with its terms; that benefits be consistently applied to similarly situated employees; and that plan benefits and coverage not be paid improperly at the expense of other participants. Accordingly, when you receive a request to cover an ex-spouse in an ERISAgoverned group health plan, you should analyze the request as follows.

- Does your group health plan provide coverage to ex-spouses outside of COBRA (that is, allow ex-spouses to remain on the plan as a dependent)?

If the answer is “no” proceed to #2. If the answer is “yes,” then the court order likely needs to be honored. If honored, be sure to correctly ascertain whether the ex-spouse is a tax dependent of the employee. That determination will govern whether coverage for the spouse can be paid on a pre-tax, versus an after-tax, basis from a cafeteria plan. The IRS has recently emphasized the significance of enforcing the cafeteria plan rules in a Chief Counsel letter, in which the IRS noted that an ex-spouse that is not a “qualifying relative” is not a dependent under Internal Revenue Code § 152 for cafeteria plan election purposes. Therefore, despite being covered under the health plan as a result of a court order (perhaps improperly), the ex-spouse was not considered a dependent for purposes of a change in status election. IRS Information Letter 2019-0013 (May 8, 2019) (because a former spouse is not a dependent under the Code, neither the death of the former spouse (changing the number of dependents) nor the nullification of the court order requiring coverage, constitutes a change in status under the regulations). - Is your group health plan self-insured or exempt from ERISA? If you answered “no,” proceed to #3. If self-insured, you primarily need to consider only federal law. If your plan excludes exspouses, the plan is on solid footing from a federal law perspective because, as stated earlier, no federal statute, or federal common law to date, mandates coverage of an exspouse. Accordingly, you can challenge the state court order to cover the spouse. From a state law perspective, any mandates requiring coverage for ex-spouses (independent of COBRA) should be preempted by ERISA, but you should consult with legal counsel to confirm.

- If your plan is insured, or is not an ERISA plan (that is, a church or governmental plan) your state’s insurance laws are generally applicable. States that mandate some form of non-COBRA continuation of health benefits for ex-spouses include, but are not limited to, Georgia, Illinois, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, Oregon and Rhode Island. Unlike self-insured plans, federal law does not preempt state laws mandating coverage of exspouses in insured plans. Accordingly, whether your plan is required to cover a spouse would be governed by the terms of your policy.

- Finally, regardless of whether your plan is selfinsured or insured, if the ex-spouse was covered under the plan at the time of the divorce, the ex-spouse is likely entitled to

- federal COBRA, provided the plan is notified

within 60 days of the date of divorce, or - state continuation coverage.

- federal COBRA, provided the plan is notified

While the application of various laws is confusing, the bottom line is that if your ERISA plan does not provide coverage for ex-spouses, there’s no need to panic if you receive a court order mandating coverage. If, after following the analysis above, you determine that coverage is required, be sure to confirm whether the ex-spouse qualifies as a dependent under the cafeteria plan regulations before providing pre-tax coverage or allowing change in status elections. Regardless of how your analysis turns, be sure to run your conclusions past experienced ERISA counsel to ensure that your plan remains compliant and to avoid state law challenges.

New Opportunities for Health Reimbursement (HRA) Arrangements

On June 13, 2019, the Departments of Treasury, Labor, and Health and Human Services (the “Departments”) issued final regulations (the “Regulations”) creating new opportunities for establishing health reimbursement arrangements (HRAs). The new rule presents a significant change from prior policy and will allow employer-funded HRAs to fund individual policy premiums and out-ofpocket costs. The rule also allows creation of “excepted benefit HRAs.” These new HRAs are available to employers of any size provided certain requirements are satisfied. The new rules do not impact the availability of a qualified small employer HRA (QSEHRA) program adopted by the 21st Century Cures Act in 2016 (the “Cures Act”).

As background, HRAs are account-based health plans that are funded with deductible employer contributions that may be used to reimburse eligible medical expenses of employees and their dependents on a tax-free basis. After enactment of the Patient Protection and Affordable Care Act (ACA), it became impossible to offer stand-alone HRAs because HRAs are considered group health plans (GHPs) subject to the ACA mandate requirements to cover certain preventive benefits and not impose annual or lifetime dollar limitations. Because HRAs cannot satisfy these requirements on a stand-alone basis, the Departments issued guidance providing that HRAs may only be offered in conjunction with participation in a group health plan that satisfies the group health plan mandates under the ACA and that does not consist solely of excepted benefits.

Prior to the ACA, HRAs could be offered to any employee to pay for unreimbursed medical expenses, including individual insurance premiums. In October 2017, President Trump instructed the Departments to promulgate regulations to “increase the usability of HRAs, to expand employers’ ability to offer HRAs to their employees, and to allow HRAs to be used in conjunction with nongroup coverage.” The final regulations described below are in addition to the prior expansion of HRAs under the Cures Act, which included a limited exception to the restriction of using HRA funds for individual insurance premiums, but that rule that only applies to small employers. Briefly, QSEHRAs are only an option for employers with fewer than 50 full-time equivalent employees that are not subject to the employer mandate and that do not offer a GHP to any employees. Qualifying small employers can opt to fund a QSEHRA to pay or reimburse employees for premiums for minimum essential coverage. This can include minimum essential coverage in the individual market. Similar to the treatment of other groupbased coverage, if an employee is covered by a QSEHRA, neither the employee nor their dependents are eligible for premium tax credits through the marketplace.

The new Regulations adopted by the Departments will be effective beginning on January 1, 2020, and create two new HRA options, which include (1) an individual coverage HRA (ICHRA) and (2) an excepted benefit HRA. An ICHRA can satisfy GHP requirements by integrating the HRA with individual market coverage or Medicare. The excepted benefit HRA will permit an employee to utilize an HRA to obtain excepted benefits like dental, vision or shortterm limited duration insurance with an HRA. In this article, we will focus on ICHRAs.

ICHRA Requirements

For ICHRAs, the Regulations established several requirements and permit the employer to offer an ICHRA to a particular class of employees. If an employer would like to offer an ICHRA to certain classes of employees and a traditional GHP to other classes, there are also rules regarding how to define the classes in a nondiscriminatory manner, which are discussed later. Below are the requirements to qualify as an ICHRA:

- All individuals covered by the HRA are enrolled in individual health insurance or Medicare and the employer must substantiate such enrollment with documentation from a third party or by attestation of the participant before any reimbursements are made. An attestation, however, will not suffice if the employer has actual knowledge that the individual is not enrolled in eligible coverage.

- Employers may not offer the same class of employees the option of an ICHRA or a traditional GHP. Only one type of HRA may be offered to the class.

- HRA coverage must be offered uniformly on the same terms and conditions to all employees in the class. The rules do permit an employer to increase the maximum benefit (1) for older

participants if that increase applies to all similarly aged participants in that class and (2) to participants with more dependents. - There must be an opt-out provision at least annually and upon termination of employment because being covered by an ICHRA will make an individual ineligible for a Premium Tax Credit (PTC).

- Employers must provide notice to eligible ICHRA employees 90 days before the beginning of a plan year that their participation in the ICHRA will make them ineligible for a PTC. For newly eligible employees, the notice must be provided no later than the date theyare first eligible to participate. The DOL has provided a model notice that can be used.

Defining a Class

If an employer would like to offer an ICHRA to one class of employees and a traditional GHP to a separate class, the employer must follow certain guidelines based on the size of the employer as follows:

- If the employer has fewer than 100 employees, the minimum class size for the ICHRA is 10

- If the employer has over 100 employees but fewer than 200, the minimum class size for the ICHRA is 10% of the total number of employees

- If the employer has over 200 employees, the minimum class size for the ICHRA is 20 employees

Additionally, the classes must be based on objective business classifications specifically outlined in the Regulations as follows:

- full-time

- part-time

- salaried

- non-salaried employees whose primary site of employment is in the same rating area

- seasonal employees

- employees covered by the same collective

bargaining agreement sponsored by the

employer - employees who have not satisfied a waiting

period - non-resident aliens with no US based income

- employees hired by a staffing firm

- any group of participants that fit into two or

more of the above classes

The rules clarify that employers may still offer retiree-only HRAs and they will not be subject to the ICHRA rules.

In light of the 90-day advance notification requirement, employers wishing to offer ICHRAs beginning January 1, 2020 will generally need to make plan design decisions quickly. While brand

new ICHRAs may have some flexibility on the timing of the advance notification, there are still many nuances within the rules that will need to be addressed. Employers should contact their advisors for additional information regarding the requirements and opportunities afforded by the expanded HRA options in the final Regulations.

IRS Circular 230 Disclosure: We inform you that any U.S. federal tax advice contained in this communication (including any attachment) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed therein. (The foregoing disclaimer has been affixed pursuant to U.S. Treasury regulations governing tax practitioners.)