A Benefit Broker Prepares Cost Estimates. A Benefit Advisor Performs Cost Management.

Many employers look at employee benefits as a commodity, bidding out their plans annually — and who can blame them? Rising health care costs, coupled with a challenging economic environment, have forced many human resources decision-makers to focus heavily on cost.

Organizations of all sizes struggle to find a balance between cost considerations and a strategy-based approach to benefit planning. Creating a competitive benefit plan, though, can directly affect employee acquisition, retention, productivity, and training. All of which significantly impact employer costs. Identifying the right advisor to assist you in successfully navigating that process is critical.

Moving Beyond the Bid

The best advisors know that earning your organization’s employee benefit business shouldn’t be a strict bidding process. Cost is just one aspect of a comprehensive strategic approach to offering your employees the right benefits for the best overall value while maintaining compliance with ever-evolving employment laws and regulations. And while it is true that a bid process can create a competitive environment that helps buyers evaluate price/value relationships, the bidding process can actually work against employers because:

- Pricing obtained through a bid process may not represent the best the marketplace has to offer. Like most businesses, insurance underwriting departments are being forced to do more work with fewer resources. They simply don’t have time to give every potential account their best effort, especially if they see the same account being repeatedly shopped through the marketplace by several brokers.

- The “come one, come all” approach works against the buyer. As a rule, most carriers work only with contract and licensed brokers. To level the playing field among brokers, the carrier provides each broker with the same quote once they receive census data and establish a rate. The downside: Though the rate is the same, there is no way to know which broker will best service the account.

- The buyer has diminished marketplace leverage. To avoid the “shopping around” perception, some buyers opt to divide brokers across specific markets. This tactic reduces market chaos, but produces far greater drawbacks. A divide and conquer approach will often deny brokers from pursuing the markets in which they have the strongest relationships. Limiting a brokers’ ability to communicate with all insurers also denies them the leverage to negotiate the best possible rates.

- The likelihood of coverage deficiencies increases. When buyers ask brokers to bid, benefits often take a back seat to price. As a consequence, the task of identifying deficiencies too often falls on the buyer — a problem made worse by the fact that proposals are typically presented in a way that makes it nearly impossible for buyers to make apples-to-apples comparisons.

- The buyer’s focus shifts from “total cost of risk” to premium. While it is important to carefully consider premium, it is critical for insurance buyers to understand and stay focused on the total cost of risk (COR), which also include:

- Losses below a set deductible

- Losses with a self-insured retention

- Losses in excess of policy limits

- The program’s administrative costs, including claims/loss control

- Lost productivity

- Retraining expenses

The bottom line: It is possible for the lowest premium to actually result in the highest overall cost.

Which Came First: The Advisor or The Carrier?

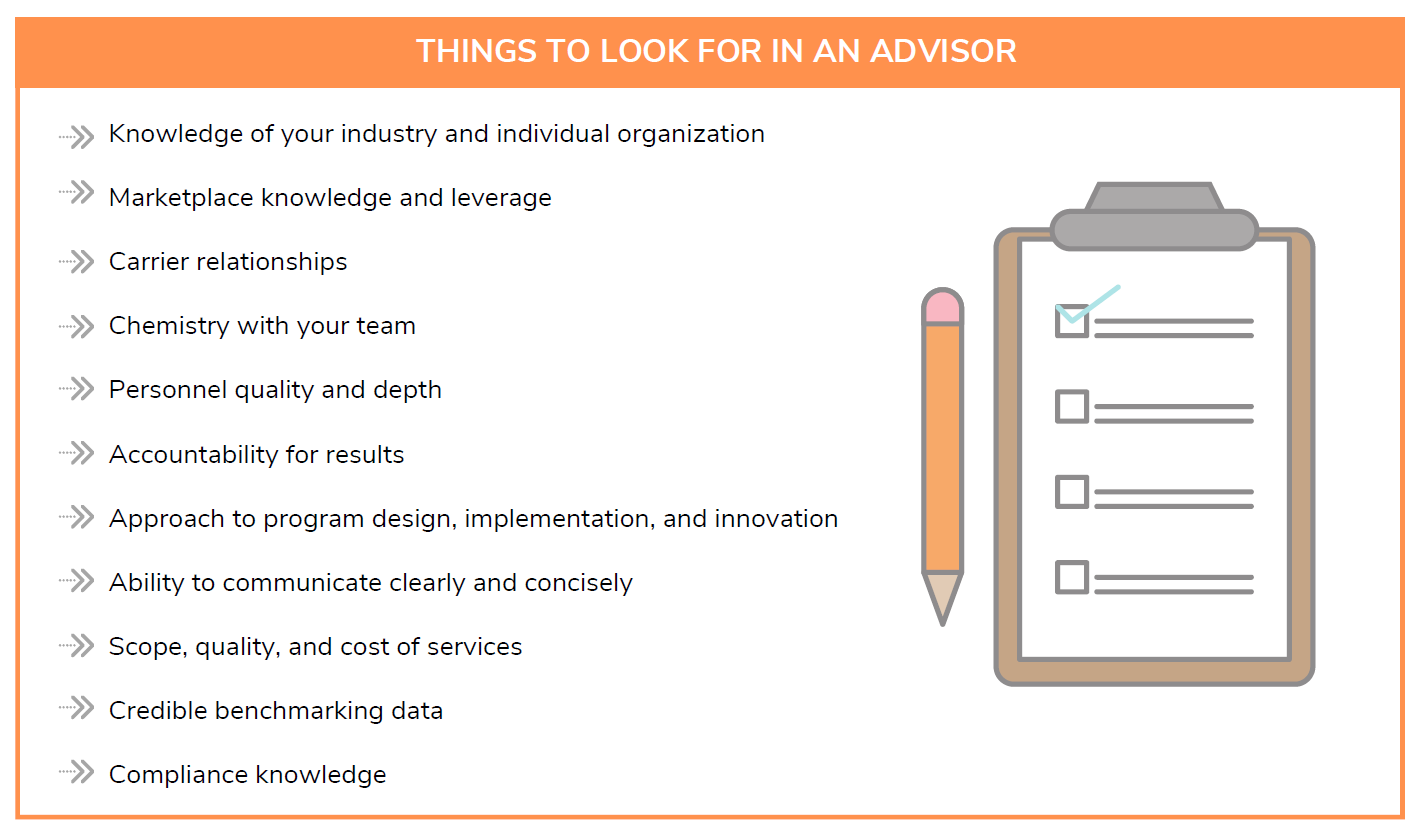

When seeking out employee benefit plans, separate the advisor decision from the insurance company decision. Selecting an adviser first ensures that fact-gathering, coordination, and analysis activities fall on the advisor, not the buyer, who may not have the time, level of expertise, or industry contacts needed to secure the best possible terms.

Selecting the right advisor first can potentially create a greater positive impact on the cost, value, and effectiveness of an organization’s employee benefits package than any individual within the buyer’s organization.

The Right Advisor is Just the Beginning

Competition among brokerage firms and among insurance companies are essential to helping businesses learn what the marketplace has to offer. A structured advisor evaluation and selection process is the best way for employers to ensure they receive optimum value and gain the competitive advantage and long-term cost management they are striving to achieve.