READ TIME: 5 MINUTES

The IRS recently published Revenue Procedure 2022-38 in which it announced its list of annual key employee benefit limits based on periodic inflation or cost-of-living adjustments. The newly announced limits represent higher than normal increases for contributions to, and permitted carryovers from, health flexible spending arrangements (HFSAs).

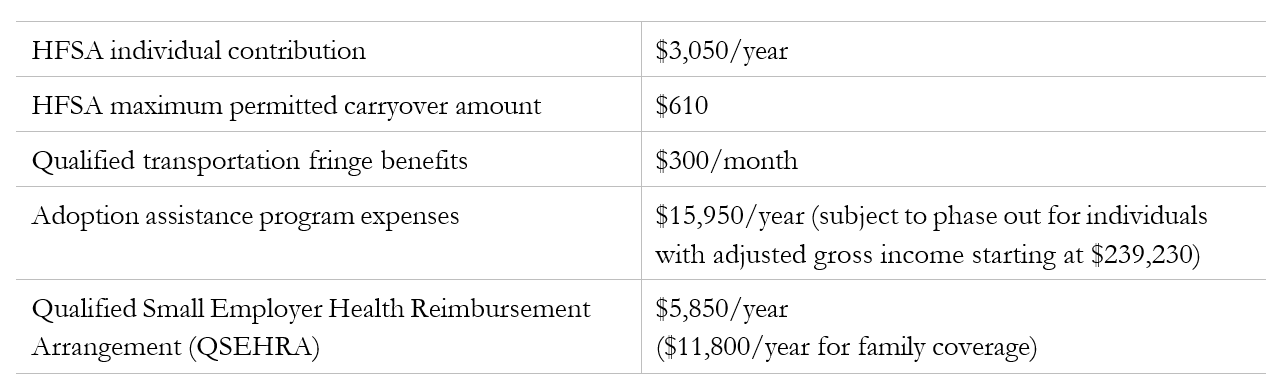

Effective for tax years beginning in 2023, the IRS imposes the following maximums:

Employers should be mindful of the adjusted limits as they prepare for 2023 and communicate with their employees regarding available benefit options. Plan sponsors also may need to amend plan documents and summary plan descriptions (SPDs) and update all payroll and human resources systems with the new dollar amount limitations. Plan sponsors will need to communicate with all necessary third-party vendors to ensure they have correctly accounted for the increased amounts.

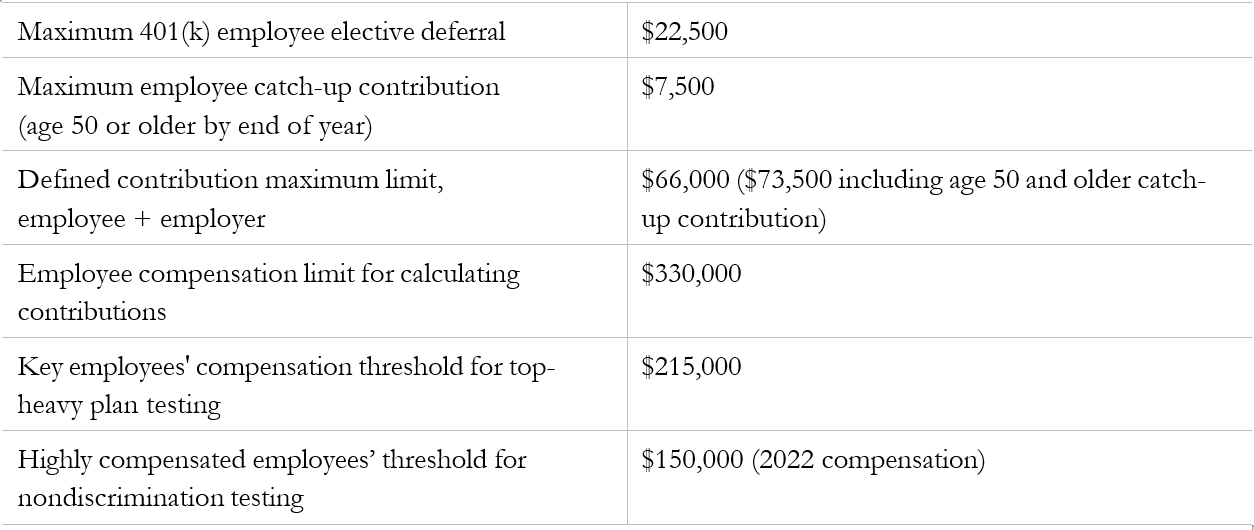

The IRS also announced in Notice 2022-55 the increased amounts relating to retirement plans:

Also, the maximum earnings subject to Social Security FICA payroll tax in 2023 will be $160,200.

Finally, the IRS has announced that employers who fail to file ACA Forms 1095 in 2024 (reporting for 2023) can be subject to a $310 penalty per form. The updated penalty for failure to provide individual statements to employees also will increase to $310 per statement. Since the penalties are cumulative, an employer who fails to provide an employee statement and fails to file with the IRS can be penalized up to $620 for each required form.

The IRS continues to be less lenient with late ACA report filers. As fines continue to increase, employers with filing obligations should take great care to ensure that their reporting processes ensure timely filing and timely distribution of individual statements.

This information has been prepared for UBA by Fisher & Phillips LLP. It is general information and provided for educational purposes only. It is not intended to provide legal advice. You should not act on this information without consulting legal counsel or other knowledgeable advisors.