Kentucky House Bill 457 applies to both fully-insured and self-funded ERISA/non-ERISA plans and places several new, costly mandates on employers that will restrict their ability to design and offer affordable prescription drugs benefits for their employees. These new mandates include provisions to restrict the use of preferred pharmacy networks (including mail-order options), management of specialty drugs, establishing reimbursement minimums, requiring PBMs to become a fiduciary, and prohibiting white bagging policies.

Employers are already having difficulty finding and attracting workers as they recover from the impacts of the COVID-19 pandemic. Now is not the time to raise their healthcare costs restricting their ability to offer affordable, high-quality health benefits to employees and their families.

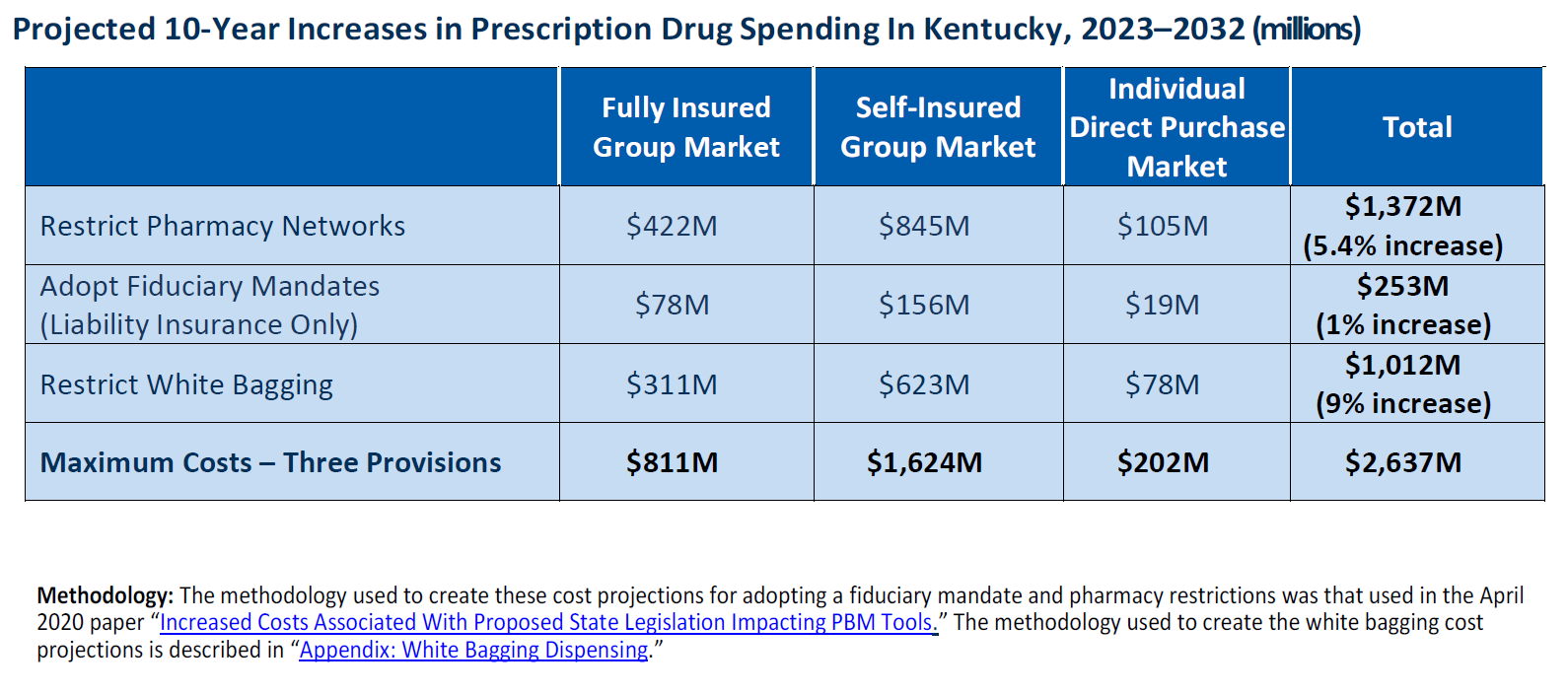

This proposed legislation will cost the state almost $3 billion in increased prescription drug costs over the next 10 years when looking at only a few key areas.

The core mission of pharmacy benefit managers (PBMs) is to reduce prescription drug costs for health plan sponsors so that consumers have affordable access to needed prescription drugs. PBMs offer a variety of services to their health-plan-sponsor clients and patients that improve prescription adherence, reduce medication errors, and manage drug costs. Health insurance costs are already a big challenge for employers of every size in Kentucky. If HB 457 becomes law, it will take away the ability of employers to utilize important strategies and flexibilities in managing their drug benefits.

Health insurance is an essential part of how we recruit and retain employees in the Commonwealth, and we believe that further restricting the tools available to keep out-of-pocket costs and premiums affordable is the wrong direction for Kentucky. Health mandates placed on employee benefits restrict insurers and employer’s ability to control costs – making the crisis in the workforce even worse.

For employers interested in taking action in opposing HB 457, the most effective thing you can do is reach out to your state legislator or members of House leadership and urge them to oppose HB457. Here are two ways in which you can do this:

- Call the legislative message hotline and ask your representative to oppose HB457, 1-800-372-7181.

- Use this drafted letter to send or email.