READ TIME: 2 MINUTES

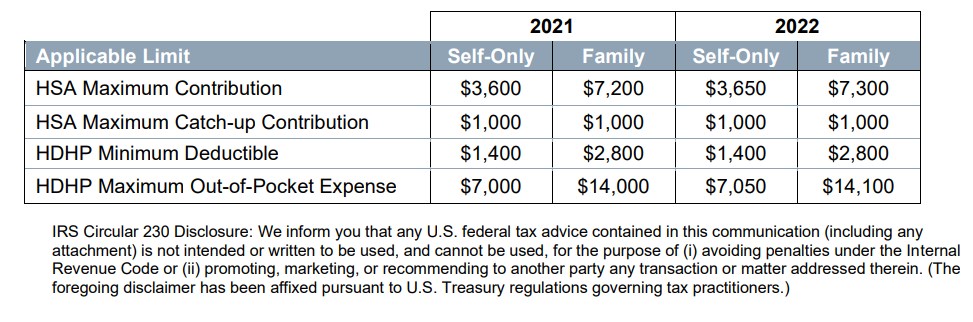

These limits will differ depending on whether an individual is covered by a self-only or family coverage tier under an HDHP.

The IRS’s new higher HSA contribution limit and HDHP out-of-pocket maximum will take effect January 1, 2022. HDHP deductible limits will increase for plan years that begin on or after January 1, 2022.

The IRS determined to leave the minimum required deductibles for HDHPs at 2021 levels, but HDHP out-of-pocket maximums will increase $50 for selfonly coverage and $100 for family coverage.

The chart below shows the old 2021 limits as well as the new 2022 limits. Also note that the maximum permitted catch-up HSA contribution for eligible individuals who are 55 or older remains unchanged for 2022.

Employers that sponsor HDHPs may need to make plan design changes as they finish 2022 planning. Additionally, affected employers will need to ensure that they update all plan communications, open enrollment materials and other documentation that addresses these limits to be sure participants and beneficiaries are adequately informed.