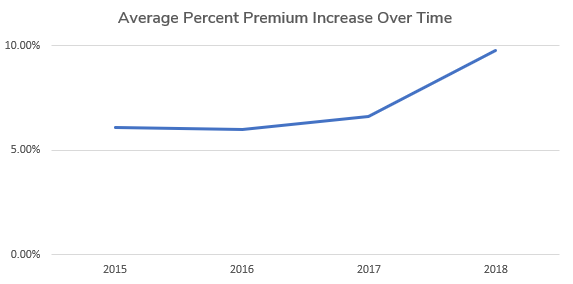

The UBA Health Plan Survey results are in and showed premiums continued to increase in 2018. One positive to note is that, as costs rise, so too does innovation in plan choice, cost structure, and other plan arrangements. According to the survey, many employers are turning to plans which can share costs with their employees and shifting the way companies of all sizes handle healthcare.

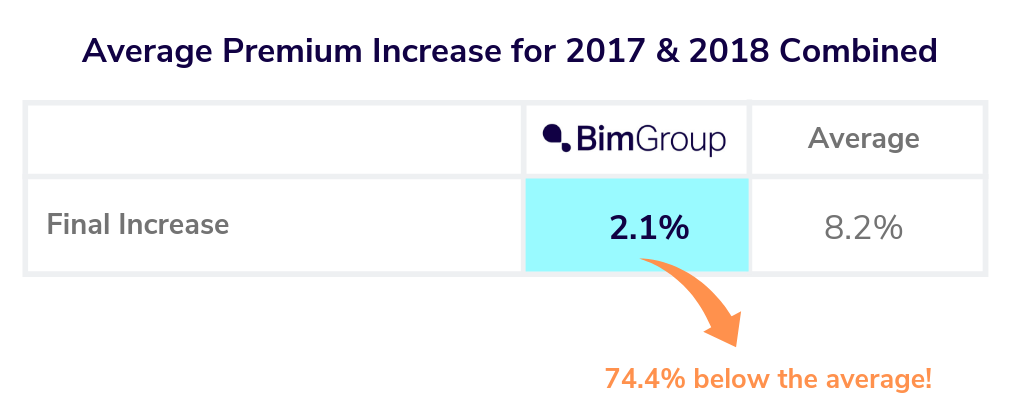

Bim Group continues to successfully keep plan cost down for clients – As you can see to the right, according to the UBA Health Plan Survey the nationwide average premium increase for 2017 and 2018 combined was 8.2%. The average increase for all Bim Group clients was at 2.1%!

Here are five trends that employers should watch over the coming year…

- Increased complexity of prescription medication benefit plans and the use of coinsurance to offset the rising cost of name brand prescription medications continued in 2018. While generic medication still has copays averaging around $10, out-of-pocket costs for name brand and specialty medications continue to rise, especially in plans with three or more tiers.

- Self-funding continues to be on the rise, with an increase to 20% of plans including a self-funding arrangement in 2018, up from 12.8% in 2017. Most significantly, self-funding has seen a sudden surge in popularity with small groups with a 122% increase in the 25 to 49 life group among small businesses.

- HMO plans, self-funding, and consumer driven health plans (CDHPs) are on the rise in some regions, while others are still dominated by preferred provider organization (PPO) plans. Many of the changes seen in the survey data could significantly affect future plan choices. Employers have grown more dynamic in choosing plans and sharing costs where they can, especially as costs for premiums and prescription medications continue to rise.

- Health maintenance organization (HMO) plans increased in popularity, especially in the West, where they account for more than 50% of plan enrollment in some states. They likely are part of the reason, along with the growing popularity of CDHPs in the region, that the West saw the only regional decrease in premiums in 2018.

- The cost of CDHPs is on the rise. In previous years, CDHPs did not see the same increases in premiums other plans did, making them ideal for small groups to save on costs when necessary. 2018 did not see a continuation of this trend and CDHPs did not provide the same refuge for small groups previously offered.

Data in the 2018 UBA Health Plan Survey is based on responses from 8,072 employers sponsoring 14,131 health plans nationwide. The size of the survey provides employers with the data they need to benchmark their plans more accurately based on plan type, region, number of employees, and industry category.

Your Customized Benchmark Survey

If you’d like to know more about the plan trends in 2018, how employers are offsetting costs, and see how these plan trends could affect your health care, reach out to Bim Group today to receive a customized benchmark survey based on industry, region, or business size.